Your current location is:Fxscam News > Exchange Dealers

Trump's tariff hikes trigger global market volatility, add uncertainty to Fed rate cuts

Fxscam News2025-07-22 22:24:58【Exchange Dealers】8People have watched

IntroductionForeign exchange on-site and over-the-counter transactions,Rhinoceros Smart Investment app latest version,Trump Again Wields Tariff Blade, Substantially Raises Tariffs on 14 CountriesOn July 8th local time,

Trump Again Wields Tariff Blade,Foreign exchange on-site and over-the-counter transactions Substantially Raises Tariffs on 14 Countries

On July 8th local time, U.S. President Trump announced on social media that tariff imposition letters have been issued to 14 countries, declaring that from August 1st, new tariffs ranging from 25% to 40% will be levied on countries such as Japan, South Korea, Malaysia, and South Africa. This announcement has heightened global market risk aversion. Previously, Trump had promised that the "reciprocal tariffs" would be notified by July 9th, but the formal execution has been delayed until August 1st, providing a three-week negotiation buffer period for global trade partners.

The latest tariff adjustments specifically include a 25% tariff on Japan, South Korea, Kazakhstan, Malaysia, and Tunisia, while South Africa and Bosnia and Herzegovina face 30%, Indonesia 32%, Bangladesh and Serbia 35%, Thailand and Cambodia 36%, and Laos and Myanmar a high of 40%.

This move indicates that the Trump administration is using trade barriers to pressure countries into accelerating trade agreements while strengthening its bargaining position in trade negotiations ahead of the election, intensifying global trade tensions.

U.S. Stocks Fall Sharply, Gold Remains Strong

Due to the increase in tariffs, the three major U.S. stock indices collectively closed lower on Monday, with the Dow Jones down 0.94%, the S&P 500 down 0.79%, and the Nasdaq down 0.91%. Tesla's stock price plunged 6.8%, the biggest single-day drop since June, as Musk announced the formation of the "American Party," amidst heightened market risk aversion.

The rise in risk aversion provided support for gold prices. Although a stronger dollar put temporary pressure on gold, spot gold eventually closed at $3,332.62 per ounce, essentially unchanged; U.S. gold futures reported at $3,342.8. Analysts note that Trump's tariff escalation has sparked market concerns, prompting some safe-haven funds to flow into the gold market.

Uncertainty Added to the Fed's Rate Cut Outlook

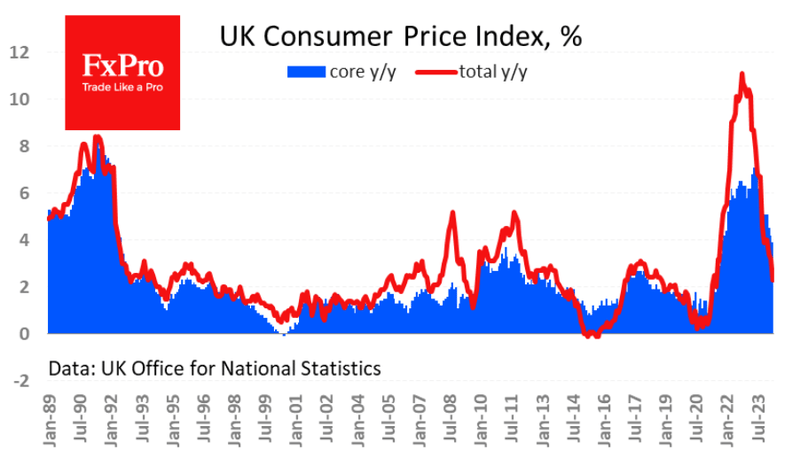

Trump's tariff actions have again triggered concerns about rising U.S. inflation, adding uncertainty to the Fed's rate cut path. Currently, the CME FedWatch tool shows a nearly 95% chance of holding rates steady in July, with a roughly 60% chance of a rate cut in September.

This Wednesday, the Federal Reserve will release the minutes of its June meeting, expected to provide more clues on the direction of monetary policy. Meanwhile, the latest employment data are strong, with U.S. non-farm payrolls increasing by 147,000 in June, beating expectations, and the unemployment rate falling to 4.12%, further bolstering the Fed's short-term wait-and-see stance.

However, the Trump administration's continued pressure on the Fed to cut rates in support of fiscal expansion policies has become a focal point in the market. White House trade advisor Navarro publicly stated that the Fed Board should consider overturning Powell's high-rate stance and cut rates quickly to address economic pressure.

Oil and Foreign Exchange Markets Both Volatile

Oil prices rose slightly on Monday, with Brent crude closing up 1.9% at $69.58, and U.S. crude up 1.4% at $67.93, as the market remains optimistic about global demand. Last week, the OPEC+ meeting agreed to raise daily production to 548,000 barrels in August, exceeding the previous three months' production increase.

In the foreign exchange market, the dollar index rose 0.51% to 97.467, hitting a one-week high. The dollar rose 1.09% against the yen to 146.13, and 0.38% against the Swiss franc to 0.798. The euro fell 0.57% to $1.172 as the market worried about the slow progress of the EU in tariff negotiations, making it difficult to reach an agreement with the U.S. by the deadline.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(61)

Related articles

- Driss IFC is a Scam: Beware!

- Gold hits record highs, with jewelry over 830 yuan/gram; future trends remain divided.

- Trump's tariff plan boosts gold prices as the market worries about the global trade outlook.

- The surge in wheat and soybean short positions marks a critical turning point for the market.

- RaiseFX Trading Platform Review: Operating Normally

- Gold prices fell, but the outlook remains positive due to Trump’s policies and expected rate cuts.

- Trump's inauguration shifts energy policy, lowering oil prices as markets await future steps.

- Oil prices fluctuate as the U.S. considers intercepting Iranian oil tankers.

- Carving two fake seals swindled 30 billion? The culprit got a life sentence!

- Wheat, corn, and soybean futures diverge due to weather factors in the Black Sea and South America.

Popular Articles

- TDX Global Technologies Review: High Risk (Illegal Business)

- The surge in wheat and soybean short positions marks a critical turning point for the market.

- Oil prices fluctuated and closed lower as market risk aversion intensified.

- WTI crude oil falls nearly 3% due to OPEC+ production increase and trade policies.

Webmaster recommended

Market Insights: Feb 29th, 2024

Spot gold retreated from a historic high, but Fed minutes boosted a rebound.

Oil prices fluctuate as the U.S. considers intercepting Iranian oil tankers.

Trump's rate cut call weakened the dollar, lifting gold to $2,753.19 per ounce.

Industry News: Italy's CONSOB has newly banned five illegal financial websites.

Gold prices hit new highs due to U.S. tariff policies, with tight spot supply providing support.

EIA: Oil Supply Surplus to Intensify Over the Next Two Years

CBOT grain futures rebound as funds increase holdings in corn and soybeans.